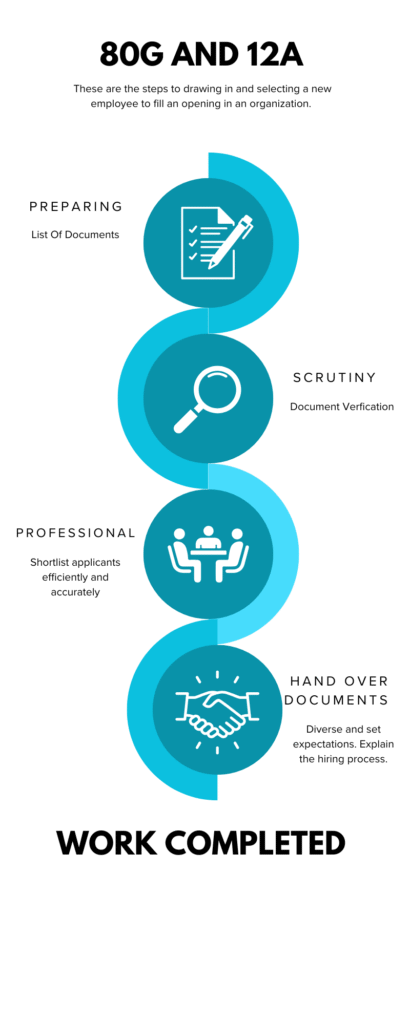

Navigating the landscape of tax exemptions for charitable organizations in India can be complex, but understanding the requirements for 80G and 12A can significantly streamline the process. To secure these vital provisions, specific documents and procedures must be meticulously followed.

For 80G registration, organizations need to prepare a comprehensive set of documents including a copy of the registration certificate, a detailed memorandum of association, and financial statements from the previous year. Additionally, proof of activities conducted in furtherance of charitable purposes is crucial. The application must also include an undertaking stating that no part of the income will be utilized for personal benefit.

Similarly, obtaining 12A registration involves submitting essential documents such as your organization’s trust deed or society registration certificate, along with a list detailing your governing body members. It’s imperative to demonstrate that your organization is genuinely engaged in charitable activities.

The procedure begins with compiling these documents and filling out the relevant application forms accurately. Submitting them to the appropriate authority—typically the Commissioner of Income Tax—will initiate your request for both registrations. Remember to keep copies of all submitted documents for future reference.

By ensuring you have all required documentation and following these procedures diligently, you position your organization not only to benefit from tax exemptions but also to enhance its credibility in pursuing its mission effectively. Don’t overlook these steps; they are essential for securing long-term sustainability and support for your charitable initiatives through 80G and 12A provisions.

2 Comments

Dear Laxmi Thanks For Generating 80G and 12A and Given Good knowledge

NGO services best plaform