Private Limited Company Registration

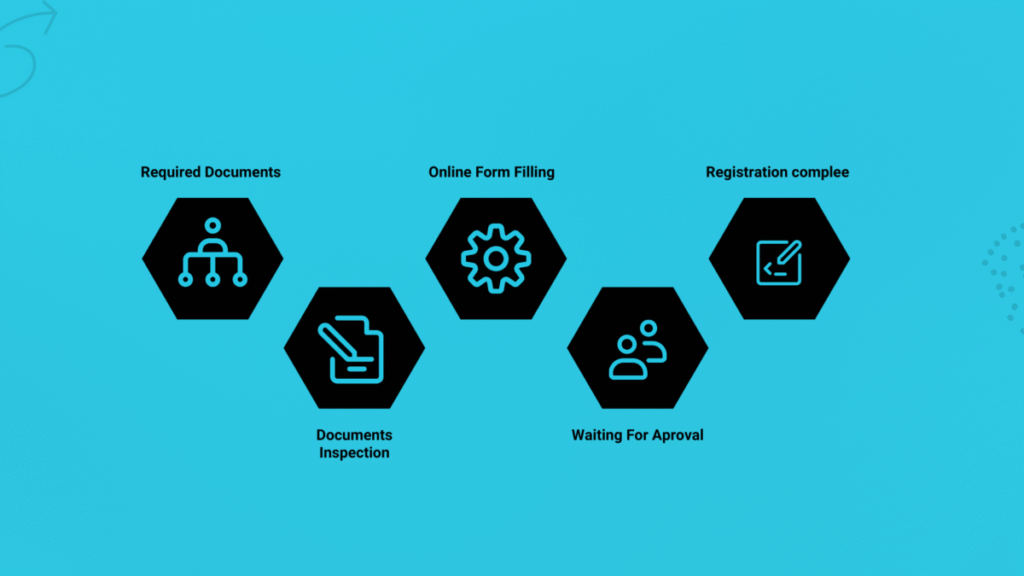

Required Documents

Memorandum of Association (MOA): This document outlines the company’s objectives, the scope of its activities, and the relationship between the company and its shareholders.

Articles of Association (AOA): These articles define the company’s internal rules, regulations, and governance structure.

Form DIR-2: This form includes the consent of the company’s directors to act as directors. It includes their personal and professional details.

Form INC-9 (Declaration by First Directors): This form includes declarations by the first directors confirming their eligibility to be directors and that they are not disqualified under the law.

Form INC-10 (Verification of Signature): This form is used to verify the signatures of subscribers to the memorandum of association.

Form INC-7 (Incorporation Document): This form includes details about the company’s registered office, share capital, and other necessary information for incorporation.

Proof of Registered Office Address: This could be in the form of a lease agreement, utility bills, or a No Objection Certificate (NOC) from the landlord.

Identity Proof of Directors and Shareholders: This could be in the form of a passport, driver’s license, or other government-issued identification.

Address Proof of Directors and Shareholders: This could be a utility bill, bank statement, or other official documents displaying the residential address.

PAN Card of Directors and Shareholders: The Permanent Account Number (PAN) is a unique identification number issued by the tax authorities.

Passport-sized Photographs: Photographs of directors and shareholders are usually required for official records.

DIN (Director Identification Number) for Directors: This is a unique identification number assigned to each director, which is required for the incorporation process.

Payment of Incorporation Fees: The required fees for company registration.