GST Registration Services

Several online platforms, such as taxpayservices.com, advertise Goods and Services Tax (GST) registration services at competitive rates, sometimes as low as ₹500. While the price point may appear attractive, businesses should carefully consider the full scope of the offered services and the potential impact on their compliance obligations.

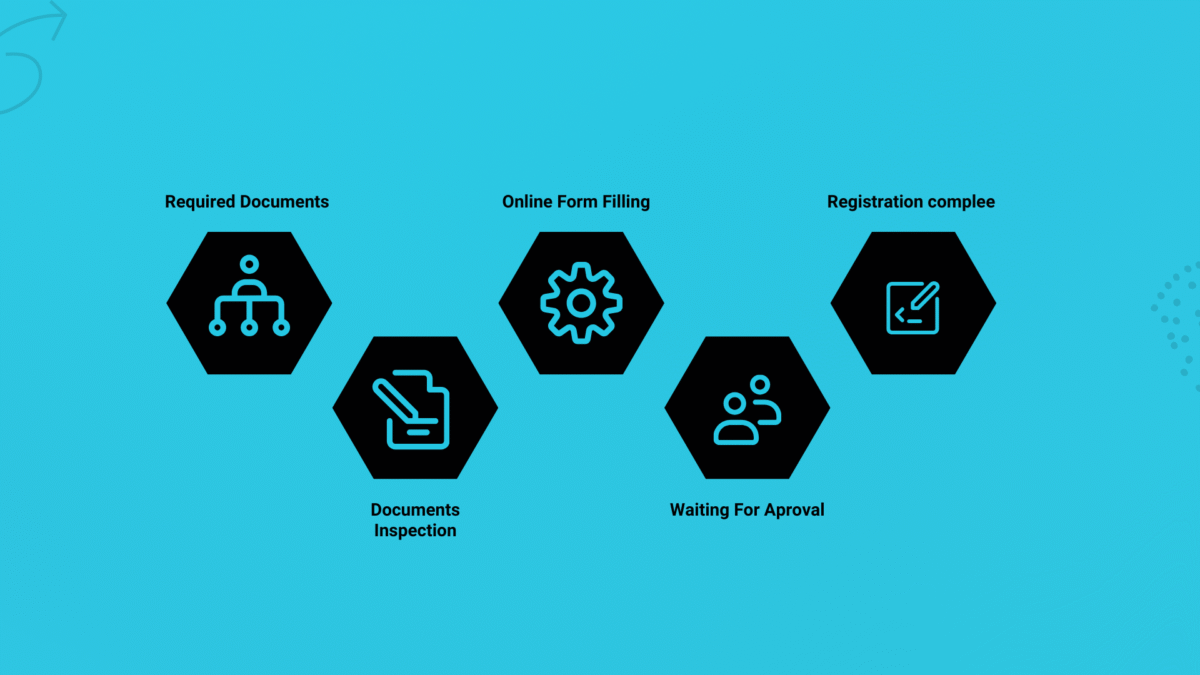

A comprehensive GST registration process typically involves not only the submission of required documents but also verification, clarification of queries raised by tax authorities, and guidance on subsequent compliance requirements.

Potential users should scrutinize the specific services included in the ₹500 package and assess whether it adequately covers all aspects of the registration process. Understanding the level of support provided and potential hidden costs is crucial to making an informed decision. Prioritizing accuracy and adherence to regulations is paramount for ensuring a smooth and compliant GST registration.

Proprietorship

GST required Documents for Proprietorship PAN,AADHAR and Bank Account, Details, Current Bill and Rental Agreement

Partnership

Partnership Deed Partner PAN, AADHAR, BANK Account Details, Rental Agreement and Current Bill

Private Limited

Incorporation Certificate, MOA,AOA, Directors PAN and Aadhar, Photo, Current Bill and Rental agreement

LLP,OPC,NGO

Incorporation Certificate, MOA,AOA, Directors PAN and Aadhar, Photo, Current Bill and Rental agreement

Good service 👍 👍